Embarking on the journey of investment can be both exciting and daunting, especially for beginners. In this beginner’s guide, we will explore the fundamental concepts of building a successful and diversified portfolio. Whether you’re new to investing or seeking to improve your current strategy.

Here are some strategies that might help you kick-start your investment journey with a diversified portfolio

- Understanding Risk and Return: Before diving into the complexities of investment, it’s essential to grasp the relationship between risk and return. All investments carry some degree of risk, and higher potential returns often come with greater risks.

- Importance of Diversification: Diversification is a crucial strategy to manage risk in your investment portfolio. By spreading your investments across various asset classes and sectors, you can reduce the impact of individual investment losses.

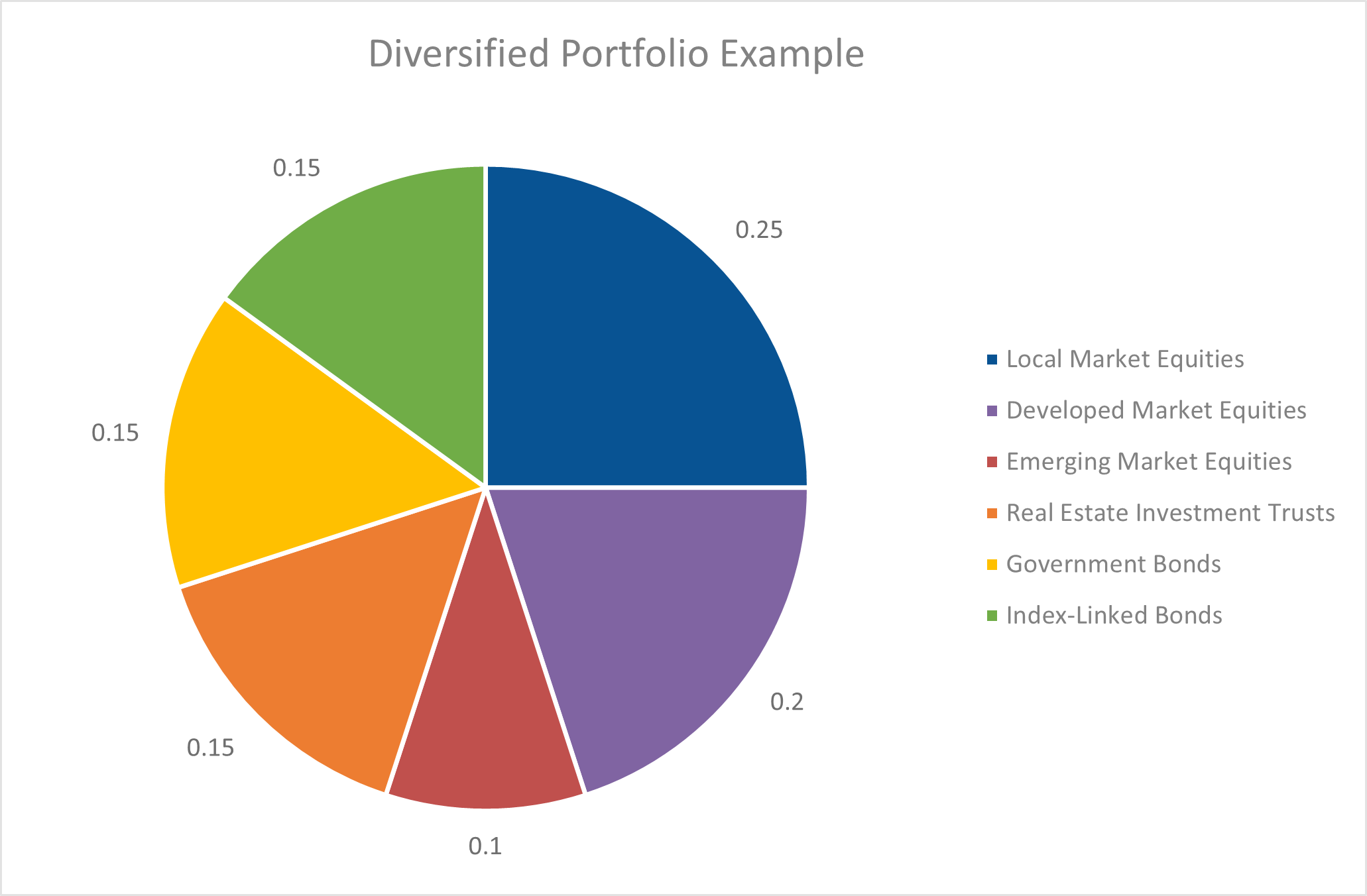

- Asset Allocation: Asset allocation involves dividing your investments among different asset classes, such as stocks, bonds, and cash equivalents. Proper asset allocation is a key driver of long-term portfolio performance.

- Stocks: The Power of Ownership: Stocks represent ownership in a company and can offer significant growth potential over the long term. However, they are also subject to market volatility.

- Bonds: Stability and Income: Bonds are fixed-income securities that provide stability to your portfolio and generate regular interest income. They are generally considered safer than stocks but offer lower growth potential.

- Mutual Funds and Exchange-Traded Funds (ETFs): Mutual funds and ETFs pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They provide a convenient way to achieve diversification with professional management.

- Risk Tolerance and Time Horizon: Understanding your risk tolerance and time horizon is crucial in crafting an investment portfolio that aligns with your financial goals and comfort level.

- Tax-Efficient Investing: Implementing tax-efficient strategies can help maximize your after-tax returns. Utilize tax-advantaged accounts such as Individual Retirement Accounts (IRAs) and 401(k)s whenever possible.

- Rebalancing Your Portfolio: Regularly review and rebalance your portfolio to ensure it remains aligned with your asset allocation goals. Rebalancing involves adjusting your investments back to their target percentages to maintain diversification.

- Long-Term Perspective: Successful investing requires patience and a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations and focus on your long-term financial objectives.

Long-Term Perspective: Weathering Market Volatility

A long-term perspective is a critical component of successful investing. In the financial markets, volatility is inevitable, with periodic fluctuations in stock prices and economic conditions. However, succumbing to short-term market movements can lead to emotional decision-making, potentially jeopardizing your investment objectives.

Investing with a long-term horizon allows you to ride out the market’s ups and downs, giving your investments the opportunity to recover from temporary setbacks. History has shown that over extended periods, the stock market tends to produce positive returns, despite occasional downturns.

The Power of Compounding

One of the most compelling aspects of long-term investing is the power of compounding. Compounding occurs when your investments generate earnings, and those earnings, in turn, reinvest and generate more earnings. Over time, this compounding effect can significantly accelerate the growth of your investment portfolio.

For example, suppose you invest in a company that pays regular dividends. By reinvesting those dividends back into the same company or other investments, you can potentially increase the number of shares you hold, which, in turn, leads to more dividends in the future. This compounding cycle can create a snowball effect, steadily building your wealth over the years.

Dollar-Cost Averaging: A Disciplined Approach

A prudent strategy for navigating market volatility is dollar-cost averaging. This approach involves investing a fixed amount of money at regular intervals, regardless of market conditions. By doing so, you purchase more shares when prices are lower and fewer shares when prices are higher. Over time, this disciplined approach can help reduce the impact of short-term market fluctuations on your overall portfolio.

Diversification: A Shield Against Risk

Diversification is a powerful tool for managing risk and maximizing returns in your investment portfolio. By allocating your investments across different asset classes, industries, and regions, you reduce the impact of any single investment’s performance on your entire portfolio.

While diversification does not guarantee profits or protect against losses, it can help smooth out the overall performance of your investments. Different asset classes, such as stocks, bonds, real estate, and commodities, often react differently to various economic conditions. A diversified portfolio can help you capture opportunities while mitigating the potential risks associated with specific investments.

Rebalancing: Staying on Course

As your investment journey progresses, it’s essential to periodically rebalance your portfolio. Rebalancing involves adjusting the allocation of your investments back to your target percentages. Market movements can cause your asset allocation to drift from its original plan. Rebalancing ensures that your portfolio remains aligned with your risk tolerance and long-term goals.

Regular reviews of your portfolio can also present opportunities to fine-tune your investment strategy. Life circumstances, financial goals, and market conditions may change over time. Periodic evaluations allow you to assess whether your investments are still in line with your objectives and make necessary adjustments.

Seeking Professional Advice

While investing can be empowering, it is essential to recognize that each individual’s financial situation is unique. Seeking advice from a qualified financial advisor can provide valuable insights tailored to your specific needs and goals. A professional advisor can help you develop a comprehensive investment plan, provide guidance during market volatility, and offer ongoing support as you progress on your financial journey.

Conclusion: A Journey of Growth and Prosperity

As you embark on the adventure of investing, remember that building a successful investment portfolio is a gradual process. Educate yourself, be patient, and stay committed to your long-term financial goals. Embrace diversification, consider your risk tolerance, and invest with a long-term perspective to weather market fluctuations.

The journey of investing is not just about managing significant sums of money; it’s about empowering yourself with financial knowledge, making informed decisions, and staying disciplined in the face of market uncertainties. Embrace the power of compounding and dollar-cost averaging to let time and consistency work in your favour.

The key is to start early, stay focused, and remain dedicated to growing your investments over time. With a well-structured and diversified investment portfolio and the guidance of a professional advisor, you can confidently navigate the world of investments and work towards building a future of growth and prosperity.

May your investment journey be rewarding, and may your financial goals be realized through a balanced, disciplined, and well-crafted investment strategy. Here’s to a prosperous future and the fulfilment of your dreams!