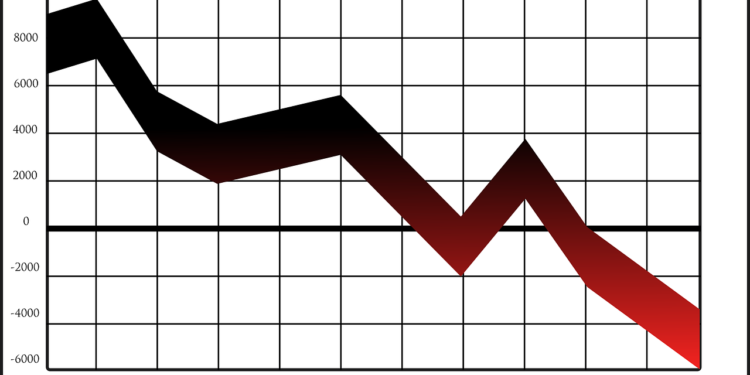

The stock market can be a difficult place to spend time. Markets are driven by investor sentiments and can fluctuate quickly based on various factors. For example, just last week, volatility reignited as the S&P 500 fell as much as 5%. While it is never ideal to see your investments go down, it’s also important to recognize when you need to take action and reevaluate your strategies. When looking at the long term, a bear market is often just a temporary blip in prices that will soon recover. With this in mind, it’s never too late to review your portfolio and look for value stocks that still have potential. Here are 10 stocks that went down 20% or more after their most recent price increase.

ProShares Ultra Nasdaq Biotechnology ETF

The Nasdaq Biotechnology Index is up 668% since the start of 2009. However, the ProShares Ultra Nasdaq Biotechnology ETF (NASDAQ: NBOT) has increased just 31% over the same period. After a strong performance in the first quarter, NBOT fell sharply in the second quarter, posting a quadruple-digit percentage decline for the month of June. During the second quarter, NBOT fell from $32.62 on May 30 to $22.74 on July 5. This dramatic fall in share price occurred during a bloodbath in the biotech sector that saw seven of the top 10 stocks in the Nasdaq Biotechnology Index fall during this period. Despite the fact that NBOT was up for the month, it still fell by more than 10% during the second quarter. Investors may want to consider making a change in their portfolio as NBOT fell from its 52-week high of $32.63 to as low as $27.73 over the past six months.

ProShares UltraShort FTSE Japan ETF

The FTSE Japan Index has increased significantly since the start of 2009, but the ProShares UltraShort FTSE Japan ETF (NYSEARCA: ETF) has increased just 24% over the same period. The ETF is designed to give investors an opportunity to profit from a potential decline in the price of shares in Japan’s top companies. Since its launch in March 2015, ETF has fallen more than 4.7% over the past six months. This sharp decline in the price of shares occurred during a period when the Japanese market fell over 18% and Japanese yen strengthened to as high as 110.04 against the US dollar. ETF is up for the year, posting a gain of 17.5% as of July 26. ETF has had a rocky start to 2016, posting a loss of 10.8% as of March 10.

iShares MSCI India ETF

The iShares MSCI India ETF (NYSEARCA: iShares MSCI India ETF) has gained more than 4,100% since the start of 2009. However, the ETF has declined in both value and price since the start of 2015. Over the past six months, the iShares MSCI India ETF has dropped more than 8%. The sharp decline in the price of the ETF occurred during a period when the Indian equity market fell more than 8%. This fall in the price of the ETF occurred as the Indian government increased the corporate tax rate to as high as 30%. The iShares MSCI India ETF is up for the year, posting a gain of 25.2% as of July 26. The ETF has had a rocky start to 2016, posting a loss of 0.6% as of March 10.

ProShares Short Russell 2000 ETF

The Russell 2000 was down 20% from its 52-week high as of late June. The ProShares Short Russell 2000 ETF (NYSEARCA: SH) fell even more during the second quarter, posting a 38% decline over the course of the three-month period. SH is up for the year, but has declined for the past three months. The ETF has had a rough start to 2016, posting a loss of 12.8% as of March 10. While the ETF is down for the year, it still has the potential for significant growth. SH has a beta of 1.02, which means it moves slightly with the overall market. SH has a low volatility factor, meaning it is less likely to swing wildly in either direction.

iShares MSCI Mexico ETF

The iShares MSCI Mexico ETF (NYSEARCA: EWW) has gained more than 1,900% since the start of 2009. However, the Mexican market has fallen significantly since the start of 2015 and EWW has dropped by more than 10% over the past six months. The Mexican market fell more than 6% during the past six months, while EWW has declined since the start of the year. During the past six months, the iShares MSCI Mexico ETF has fallen from its 52-week high of $24.75. The ETF is up for the year, posting a gain of 33.4% as of July 26. EWW has had a rough start to 2016, posting a loss of 7.6% as of March 10.

ProShares UltraShort Russell 2000 ETF

The iShares MSCI Turkey Investable Market ETF (NYSEARCA: TUR) has increased more than 2,300% since the start of 2009. However, the ProShares UltraShort Russell 2000 ETF (NYSEARCA: UBSH) has only increased about 800% over the same period. UBSH has been on a decline since the start of 2015, posting a decline of more than 7% during the past six months. During the past six months, the iShares MSCI Turkey Investable Market ETF has fallen from its 52-week high of $16.00. The ETF is up for the year, posting a gain of 12.8% as of July 26. UBSH has had a rough start to 2016, posting a loss of 11.4% as of March 10.

PowerShares Dynamic Market Strategies Portfolio

The PowerShares Dynamic Market Strategies Portfolio (NYSEARCA: PDS) is designed to provide investors with the opportunity to participate in two market strategies. It is designed to provide the short equity strategy and the long volatility strategy. PDS has a short beta of 0.92, which means it will move slightly with the overall market. However, it has a very low volatility factor, which suggests it is less likely to swing in either direction. PDS has a low risk factor, which indicates it is not as likely to lose money over the short term.

Final Thoughts

It’s never too late to build a successful investment portfolio. It’s never too late to build a successful investment portfolio. As long as you’re alive, there will always be new opportunities to invest. In order to stay ahead of the competition, it’s important to periodically review your strategies and make adjustments as necessary. It’s also important to remember that no matter how good your investments are, there are always going to be times when they go down. This is simply a fact of life that you need to be prepared for.