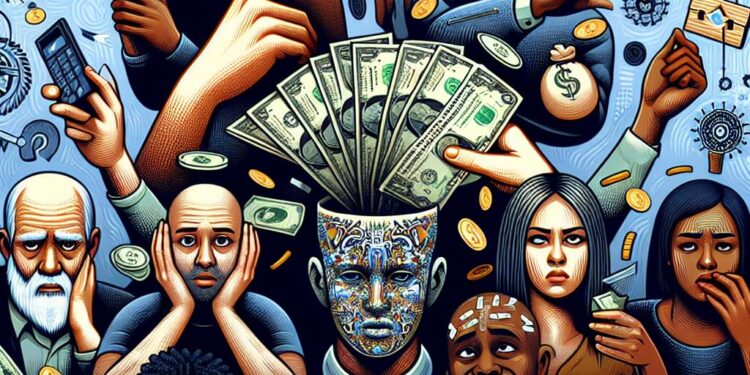

Ever wonder why sometimes you just can’t resist that impulse buy, even when you know you should save? Welcome to the fascinating world of “The Psychology of Money: How Emotions Influence Spending.” Understanding this can be a game-changer in your financial planning and investment strategy. Many folks mistakenly believe finances are all about numbers and calculations, ignoring the powerful role emotions play. This blog will unravel those emotional triggers and provide practical tips to control them, helping you build long-term wealth and financial security. Ready to dive in and make smarter decisions with your money? Let’s get started!

How Do Emotions Affect Our Spending?

Ever found yourself grappling with the urge between splurging on a luxury item and squirreling away your cash? That’s the psychology of money at play, an unseen force dictating our financial decisions. It’s not just about numbers; it’s about emotions, memories, and behaviours formed over time. At its core, the psychology of money explores how our feelings affect spending habits, investment choices, and overall financial health. Imagine it like going to the gym for your brain: just as physical exercise strengthens muscles, understanding your financial emotions bolsters your wallet.In personal finance, acknowledging these emotions can lead to better budget management and help avoid impulsive purchasing. For investments, it’s about resisting panic during market downturns and avoiding greed in boom times. Picture this: you’re choosing between instant gratification and long-term stability. Mastering this balance is key to building wealth. So, next time you’re in a financial bind, ask yourself—are you driven by needs or simply nudged by emotions?

How Emotions Impact Our Spending Habits

Understanding “The Psychology of Money: How Emotions Influence Spending” is vital because it sheds light on why individuals make financial decisions that may not always align with their best interests. By recognising how emotions drive spending habits, one can start to identify patterns and triggers that lead to impulsive purchases or poor financial choices. This insight lays the groundwork for developing greater self-awareness and discipline in managing money. It promotes a deeper comprehension of personal financial behaviours, equipping people to make more rational, informed decisions, ultimately fostering a healthier relationship with money. By understanding these dynamics, individuals can work towards achieving their long-term financial goals.The Psychology of Money: Emotions in Spending

- Impulse Purchases: Imagine you’re in a store (or browsing online, perhaps?). You see a luxury item that grabs your attention—tempting, right? It’s this emotional pull that often leads to buying things you don’t need. Investors, too, can sometimes buy stocks on whims, influenced by market hype.

- Decision Paralysis: You’re overwhelmed with choices, aren’t you? That’s when people struggle to make sound decisions. Financial advisors play a crucial role here, guiding you through options and making the process feel less daunting.

- Fear of Missing Out (FOMO): Everyone’s buzzing about the latest investment trend. Do you feel the itch to join in? This emotional response can lead to hasty decisions, which platforms and advisors help to mitigate through educational resources.

- Regrets and Anxiety: After impulsive spending or missing out on opportunities, you might feel regret. Regulators ensure transparent practices, allowing you peace of mind and more informed decision-making.

- Building Financial Wisdom: Over time, learning from emotional spending teaches you to manage emotions better. Engaging with advisory services helps craft a practical, emotionally balanced financial strategy.

Exploring Emotional Impact: How Feelings Shape Our Financial Choices

| Benefits | Risks/Disadvantages (The Psychology of Money: How Emotions Influence Spending) |

|---|---|

|

|

Harnessing Emotional Insights for Smarter Financial Decisions and Spending Habits

1. Personal Budgeting and Control: Individuals use principles from ‘The Psychology of Money: How Emotions Influence Spending’ to gain control over impulsive buying. Jen, a 30-year-old nurse, once unable to resist sales, now applies emotional awareness to stick to her shopping list, saving hundreds monthly.2. Investment Firms: Investment advisors integrate psychological insights to guide clients towards stable financial planning. These firms recognize that understanding emotional triggers can prevent panic selling during market dips.

3. Financial Education Workshops: Workshops use this book to teach the emotional aspects of money management, helping people develop a healthier relationship with cash—leading to sustained financial wellbeing.

4. Corporate Training: Companies include the book’s insights in employee training, aiming to foster financial responsibility and reduce stress, which can improve productivity and job satisfaction.

5. Policy Making: Policymakers consider emotional and psychological factors when designing savings programs and financial wellness policies, increasing participation and adherence rates.

A cautionary tale: Despite these insights, Greg, a stockbroker, ignored them, leading to reckless financial gambles driven by hype—undermining his career and financial stability. His story illustrates the book’s significance in understanding emotional influences.

Comparing Emotional Spending with Rational Financial Decisions: A Psychological Insight

| Resource | Type | Key Focus |

|---|---|---|

| “The Psychology of Money” by Morgan Housel | Book | Explores the emotional and psychological aspects of financial decisions. |

| NPR’s “Planet Money” | Podcast | Covers diverse financial topics, emphasizing the psychology behind money decisions. |

| Ramit Sethi’s “I Will Teach You to Be Rich” | Book | Combines practical money management with insights into financial psychology. |

| Behavioral Finance Course on Coursera | Online Course | Teaches how psychological factors affect financial decision-making. |

| Freakonomics | Podcast | Examines economic and financial behavior with a psychological lens. |

| TED Talks: Your Body Language May Shape Who You Are (Amy Cuddy) | Video | Discusses how psychological insights can influence personal and financial behavior. |

Mastering Finance for Modern Freelancers: Boost Your Wealth Wisely

- Tech-Savvy Millennials: These individuals love gadgets and the latest apps but aim to balance tech indulgence with saving for the future. They’re keen on understanding how emotions can impact spending decisions.

- Risk-Tolerant Investors: Always ready to dive into new ventures, these investors would benefit from insights into how emotions can drive risk-taking behaviour, helping them make more logical choices.

- Early Retirees: Focused on preserving their wealth, early retirees need awareness of emotional spending triggers to maintain financial independence in their golden years.

- New Parents: Balancing new expenses and savings, they must comprehend how emotions could influence their budgeting, ensuring a secure financial future for their family.

Future of Money Psychology: Emotional Spending Trends Ahead

Understanding the psychology of money is an ever-evolving field, especially as technology and societal changes influence our financial habits. Here’s where this fascinating area is headed:- Tech-Driven Personal Finance: Advances in artificial intelligence and machine learning are helping people make more rational financial decisions by predicting spending patterns and offering personalised budgeting advice. This can significantly reduce impulsive purchases, driven by emotional triggers.

- Regulatory Policies: Governments are exploring new policies to promote financial literacy. Initiatives focused on teaching the psychological aspects of spending could lead to more financially aware citizens who make decisions based on logic rather than emotion.

- Market Trends: There’s growing interest in behavioural finance, which integrates psychological insights into economic models. This trend will likely continue, influencing how both companies and consumers understand spending behaviours.